Sings of Panic: Yield Curves are getting steeper

In the USA, which is the largest economy in the world, it is considered certain that Democrats, who have the upper hand in the House of Representatives and Congress, will pass a comprehensive financial support against the economic effects of the pandemic. However, the stock market indices, which climbed to the top of all time with the optimism, got into a turbulence as February ends.

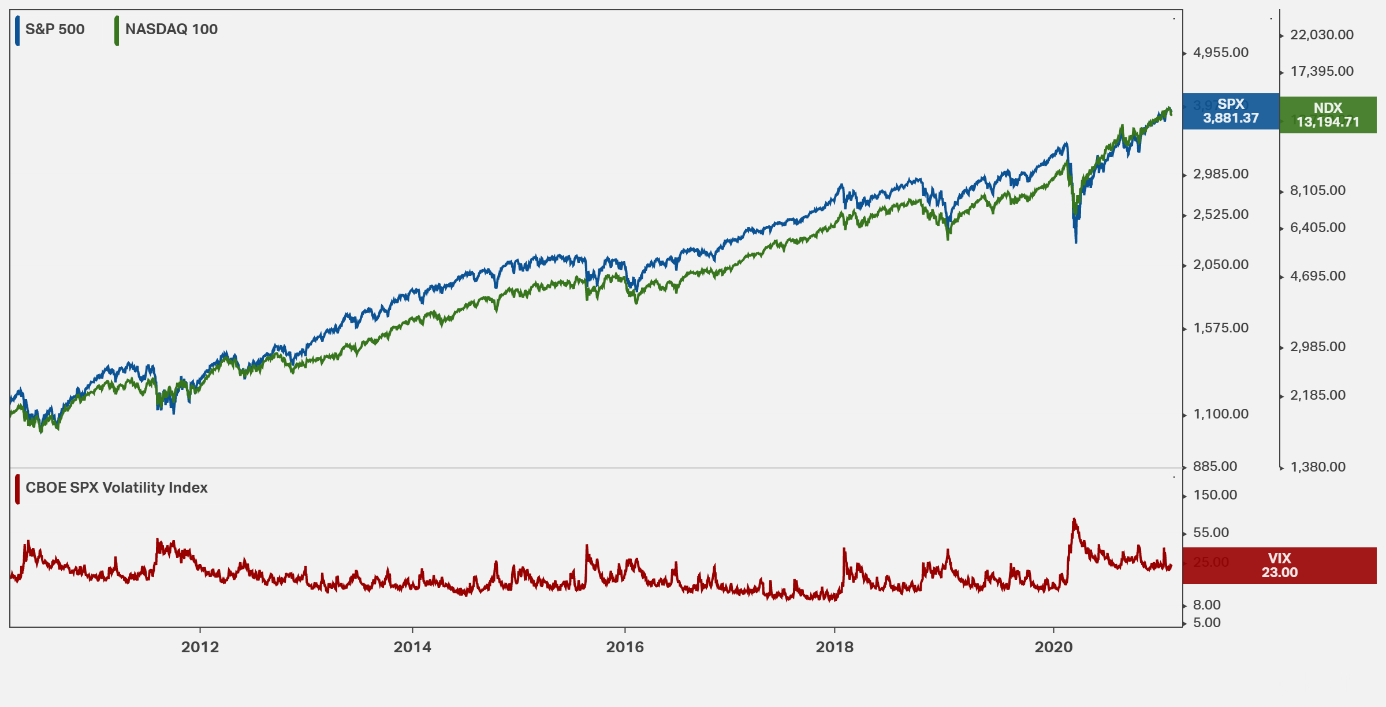

As of yesterday, SP500 index, which opened from 3 880 points, closed at 3 882 after falling to 3 809 with a loss of more than 1.8 percent. And NQ100 index, which started the day from 13 243 points, closed at 13 197 points after falling to 12 763 points with a loss of close to 4 percent. The reason for this increased volatility in the US indices and concerns about how long it will continue has started to arise among market participants.

The Fed lowered its federal funds target to a range of 0 to 0.25 percent in order to create a buffer against the economic effects of the pandemic and lifted the limits on monetary expansion. Although the Fed's ultra-loose monetary policy minimized economic damage during the pandemic, with the support of low-cost abundant liquidity, household consumption started to recover. The direct support of the Congress, especially the transfer method, and the low borrowing cost dollar liquidity linked to the policies of the Fed directed household consumption towards the durable goods and housing expenditures.

The current account deficit, which is heavily impacted by durable goods in the United States, which is the world's largest importer, saw a 14-year peak of $ 68.1 billion, mainly due to a rise in international commodity prices, mainly crude oil. On the other hand, double deficit expectations dominated markets, given that the federal budget's record deficit in 2020 to combat the economic effects of the outbreak will continue to grow, along with a new $ 1.9 trillion stimulus package announced by Democratic President Joe Biden.

As a matter of fact, it did not take long for the rise in prices, led by durable goods and housing, to increase inflation expectations by strengthening with the double deficit expectations. After that, interest rates on 10-year U.S. bonds, which are considered indicators in the debt instruments market, rose to a 1-year high of 1.39 percent. In other words, rising expectations due to the strong expansion of monetary and fiscal authority in the world's largest economy also affected inflation expectations upward, causing the price of long-term bonds to fall and interest rates to rise. Also, the opening of positive difference between long-term interest rates and short-term interest rates became inevitable. At the same time, the rise of the risk-free yield of the dollar, the most important reserve currency, put downward pressure on stock market indices that are in the relatively risky group.

It is clearly indicated that the increase in inflation and inflation expectations is in the attention of policy makers, but that the said increase is considered to be short-term according to Fed's minutes for January meeting. In this context, it is also clear that the Fed will not take control of the yield curve on the agenda, especially if the psychological limit line of US 10-year bond interest rates, 1.75 percent, is not exceeded permanently.

On the other hand, looking at the 10-year development of the two most important US stock markets, it is clear that the potential for growth continues. Although an increase in risk-free yield bond interest rates creates some loss of momentum in the indices, it is not possible to expect an aggressive decline in the indices if interest rates do not exceed critical threshold levels in a setting, where risk appetite is alive (VIX:23.00).