Fri Aug 05, 2022

Nonfarm Payrolls will determine the Fed's Rate Hike Decision in September

Under the shadow of the recession discussions for the world's largest economy, the markets are focused on the labor statistics to be announced at 14:30 (GMT+2) today.

In the report that the Bureau of Labor Statistics (BoLS) of the US Department of Labor will publish for July, the markets expect that nonfarm payrolls will increase by 250 thousand.

The US economy is an economic recession after a minus 1.6 percent gross domestic product (GDP) in the first quarter and minus 0.9 percent (despite the forecasts of plus 0.5 percent) in the second quarter of 2022. However, Fed Chair Jerome Powell, who spoke to the press after the critical July meeting, when the US Federal Reserve went to raise rates by 75 basis points, said that there is no recession in the US economy, however, the labor market is extraordinarily tight.

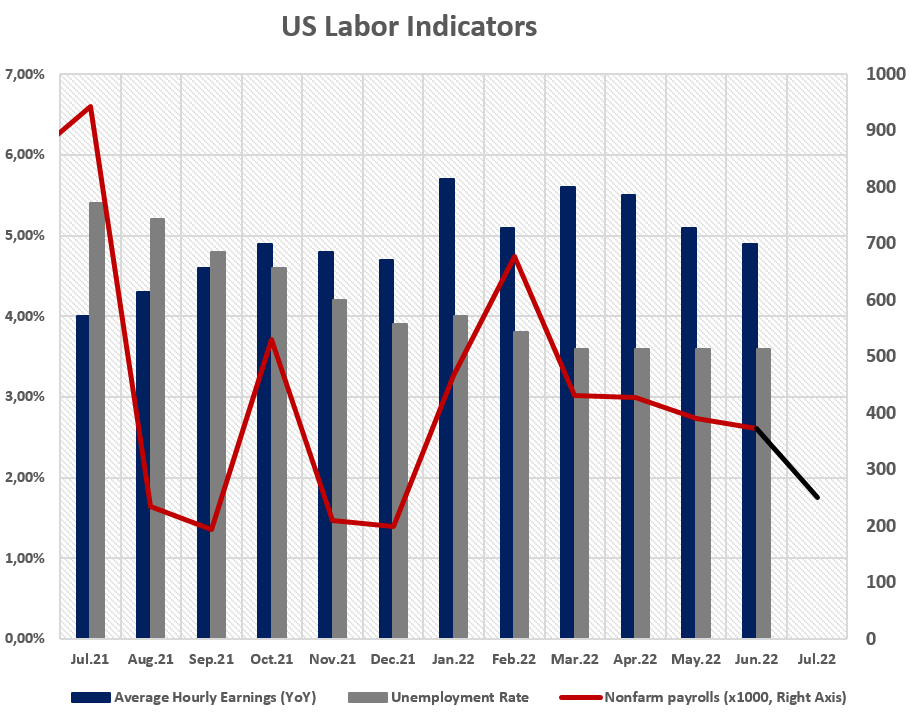

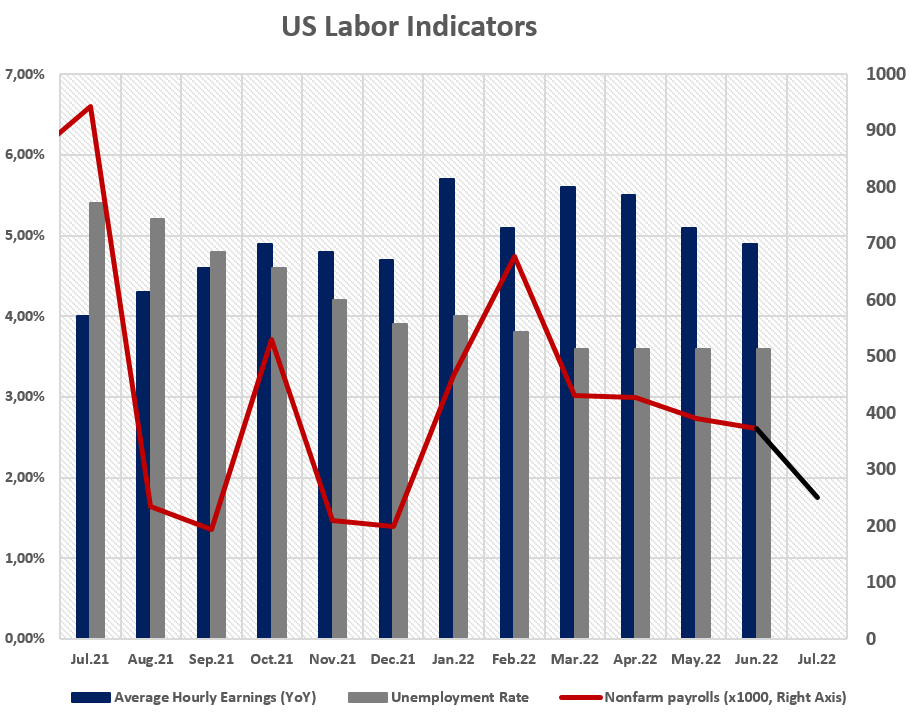

Powell's statement that it would be appropriate to slow down interest rate hikes at some point, but left open the door that another unusually large rate hike could be made at the next meeting if necessary, where the Fed perceived the change in labor market conditions on the way to controlling inflation as a determinant of the pace of monetary tightening. Indeed, in today's report, the markets project the unemployment rate to be at 3.6 percent and the annual change in average hourly earnings to be 4.9 percent.

At this point, Russian – Ukrainian war, lockdowns in China, and the energy crisis putting pressure on Europe led the Fed to start rate hikes in March and continued this in June and July, increasing the financing costs and putting downward effect on the labor force.

Although it is not defined as a recession, the easing of labor market conditions in the US economy, which is technically considered to be in recession, may force the Fed to reduce its pace in aggressive tightening. On the other hand, the data that will confirm the tight conditions in the labor market may strengthen the Fed's hand a little more on the path it is aiming for inflation.

If the nonfarm payrolls in today's data set exceeded forecasts of 250 thousand and average hourly earnings at 4.9 percent, it may create the expectation in the markets that the Fed will maintain its aggressive tightening momentum and set the stage for pricing in the future of another 75 basis point rate hike at the September meeting. Proceeding from this, the possibility of the real interest rate of the dollar rising above the neutral level may also put pressure on international assets. Here, US dollar index may exceed 107 level again and the gold prices may decline below critical 1750 USD support.