Borrowing Costs Hit Historic Low

The markets completed 2020, when they met with Black Swan, with the record high stock market indices and historically low interest rates due to the policies of the central banks of developed and developing countries. In the new year, global liquidity is looking for an investment instrument, as expectations dominate that central banks in developed countries will maintain their policy of monetary expansion.

After the coronavirus was declared as a pandemic by the World Health Organization (WHO), central banks of developed and developing countries, especially the Federal Reserve, resorted to aggressive monetary expansion in order to minimize the devastating effects of the pandemic. In addition to repeatedly resorting to extraordinary meetings and unlimited monetary expansion to support households and businesses, the Fed, which is in a position to direct global monetary policy, established swap lines with central banks of developed and developing countries to meet the liquidity that the markets will need.

Following the Fed, the European Central Bank (ECB) kept the interest rates at 0 percent, activating 750 billion-euro Pandemic Emergency Purchase Program (PEPP). The Bank of England (BoE) changed its rates to 0.10 percent and increased its Quantitative Easing program to 645B from 435B pounds. Then, BoE decided to increase this amount to 745B pounds. In Asia, the People's Bank of China (PBoC) raised its 1-year loan prime rate (LPR) to 3.85 percent and its 5-year loan prime rate (LPR) to 4.65 percent, while the Bank of Japan (BoJ) removed the limits of monetary expansion without changing the policy interest rate, which is minus 0.10 percent. Afterwards, the ECB increased the quantitative easing to 1.85B euros and the BoE to 875B pounds.

Fighting against the economic effects of the pandemic, financial authorities, compared to the central banks of developed and developing countries, who resorted to a low-cost path of abundant liquidity, also implemented a budget expansion through borrowing in addition to various subsidies. Especially in the United States, the world's largest economy, the Federal Budget announced a record-breaking financial aid.

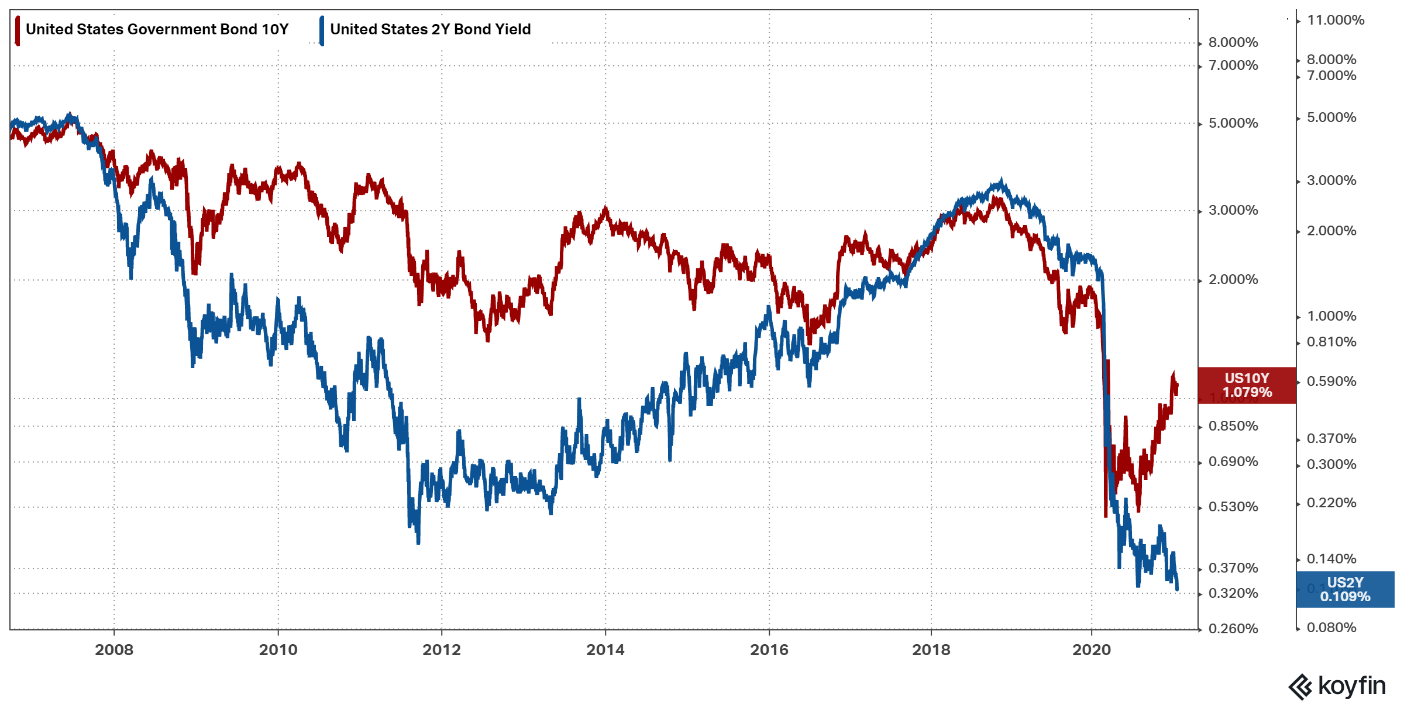

The fact that financial governments of developed and developing countries also provide low-cost liquidity through U.S. bond rates, which are considered indicators in the debt instrument market, made a significant contribution to this fight against Covid-19.

But the low-cost abundant liquidity that central banks injected into markets started to seek for returns. Especially after the Black Swan effect that the pandemic brought to markets, in the context of controlling the pandemic globally and opening up economies, increased risk appetite flocked to stock market indices and emerging country currencies.

Hence, the second wave did not harm the markets compared to the first wave. In addition, S&P 500 index, consisting of a basket of shares of the largest 500 companies in the United States, reached the record-high, which is 3 868. In addition DowJones30 and Nasdaq 100 hit their highest levels with 31 287 and 13 610 levels. Meanwhile, EuroStoxx50 rose to 3 657 and Shanghai index of Asia reached 3 637.

On the other hand, risk appetite associated with the global vaccination campaign against the pandemic continues its positive course, while uncertainty about reducing the cases to the extent that will not do harm to public health also keeps the risks in the economic outlook alive. The question of when economic activity will recover also brings with it expectations that the central banks of developed countries will continue their quantitative easing policies. In addition, liquidity, which is abundant in the borrowing instruments, plays an important role in reducing costs. In particular, it is worth noting that the LIBOR (London Interbank Offered Rate), used by banks for borrowing funds in US dollars, declined to 0.2018 percent, which is a historic low.

To sum up, LIBOR rate may contribute to the banks to use loans against low-cost lending and that banks do not need much more resources compared to the pandemic period. The decline in the US 2-year bond interest rates plays an important role, especially in finding resources that will allow governments to expand the budget against the pandemic. In contrast, the premium on US 10-year bonds points to an increasingly inclined yield curve, meaning that inflation expectations are upward. In addition, depending on the fact that low-cost liquidity maintains its presence in the markets, it will be wise to expect that the positive outlook in stock market indices will continue.