Wednesday / October 27

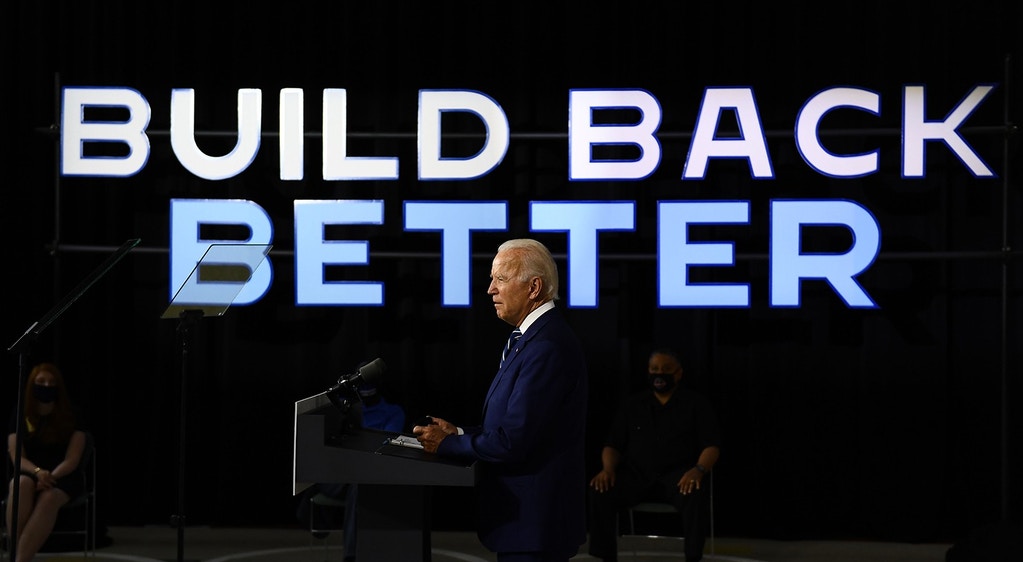

Biden’s economic plans

Congressional democrats in the US announced that they are making progress on a comprehensive bill to expand the social programs, a key policy pursued by President Biden want.

Heading the intra-party negotiations on the issue, the party leaders Schumer and Pelosi and other democratic senators made positive statements Tuesday.

“We are closer to an agreement,” said Schumer, speaking after a lunch with the party caucus, including senators Sanders and Manchin. Similar statements came from other Democratic Congress leaders, Pelosi and Hoyer. Warren said she expected a deal within 48 hours.

Democrats, divided moderates and progressives, still debate the details of their disagreements over issues like taxes, drug pricing, family leave, climate change and immigration.

The leftist group in the House, led by Ocasio-Cortez, is blocking the passage of a Senate-approved $1 trillion infrastructure bill, which was passed with the support of 19 Republicans, in an effort to force the democratic leadership for a social spending package of at least $3.5 trillion. Centrist senators led by Manchin and Cinema want a package of less than $2 trillion, citing the inflationary and tax burden of overspending. A figure agreed by Democrats has yet to be announced.

Hoyer added that the bipartisan infrastructure bill could likely pass this week if the framework is agreed to persuade progressives on social spending.

Crypto regulation

Jelena McWilliams, head of the US Federal Deposit Insurance Corporation (FDIC), said authorities want to provide a clearer roadmap for banks and their customers that accept cryptocurrencies to maintain control over rapidly evolving digital assets.

In an interview with Reuters, McWilliams stated that a team of US bank regulators could introduce clearer rules for banks and their customers to hold cryptocurrencies, use them as collateral for loans, and even hold them on their balance sheets like more traditional assets.

“I think that we need to allow banks in this space, while appropriately managing and mitigating risk,” McWilliams said. “If we don’t bring this activity inside the banks, it is going to develop outside of the banks…The federal regulators won’t be able to regulate it,” she said.

US consumer confidence

In the US, consumer confidence unexpectedly rose in October as concerns over high inflation were offset by improved labor market expectations.

The consumer confidence index, released by the research organization Conference Board on Tuesday, rose to 113.8 for this month from 109.8 in September. The three-month decline in the index has come to an end.

US stocks

U.S. stocks soared to record highs on Tuesday as major companies announced solid quarterly earnings results.

The Dow Jones Industrial Average earned 15.73 points, reaching a record high of 35,756.88. The S&P 500 rose nearly 0.2% to 4,574.79, setting a new record. The Nasdaq Composite Index rose less than 0.1% to 15,235.71.

The intraday reversal in Facebook shares weighed on the larger market. Facebook shares fell more than 5% at session lows, closing down 3.9%. The company beat analysts’ earnings expectations but missed its revenue and monthly active user estimates.

Tesla fell 0.6% on Tuesday after rising more than 12% after hitting $1 trillion in market cap for the first time in the previous session.